The rout extended a miserable month for markets that has seen all three major indexes wipe out their gains since the US presidential election in November.

The widespread selloff was mostly driven by anxiety about the impact of Trump’s tariffs. In an interview that aired Sunday, Trump said the US economy would see “a period of transition” and refused to rule out a recession.

When asked on Fox News’ “Sunday Morning Futures With Maria Bartiromo” if he was expecting a recession this year, Trump said “I hate to predict things like that. There is a period of transition because what we’re doing is very big.”

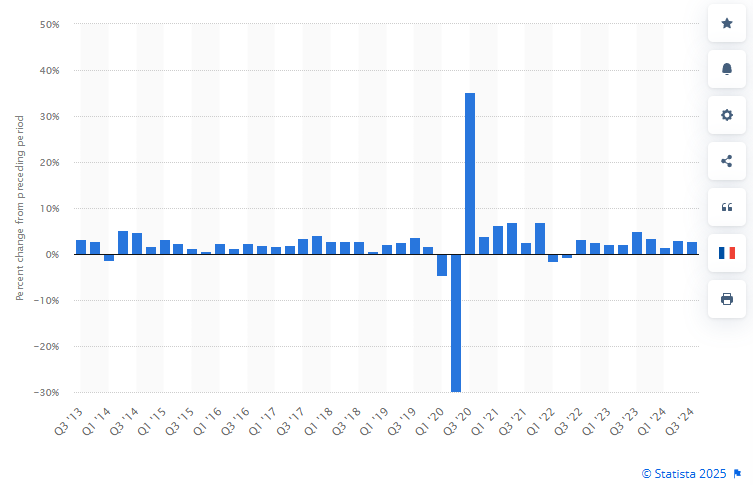

The classic definition of a recession is two consecutive quarters of GDP contraction. By that definition, we’ve had two recessions in the last five years.

Find more statistics at Statista

The pandemic recession is obvious. But remember that recession in 2022 that everyone ignored? We were told that it wasn’t really a recession because look at all of these other stats blah blah blah. But it was a recession and by ignoring it, we did not take corrective action.

Since then (and before), we have been propping up our GDP with insane levels of government spending. All of that spending has been fueled by debt. It is unsustainable.

For those of us in the private sector, I don’t think we ever really recovered from the 2022 recession. Several sectors of our economy have continued to struggle and have been contracting. Inflation and government spending have masked it, but it’s real.

What I hope we will see now is restraint in government spending and getting inflation under control. Those things will both uncover the already weak spots in our economy and trigger a recession in the parts being propped up by government spending (think renewable energy, real estate, healthcare, education, higher ed, etc).

This will hurt, but it is also necessary. A capitalist economy is not meant to never contract. It must, in fact, do so in order to force capital out of inflated parts of the economy and into more productive parts. The boom-and-bust cycle is not a bug of a healthy economy. It is a feature.

Furthermore, if we don’t get government spending (funded by debt) under control, we risk completely devaluing our currency and trigger nation-killing hyperinflation. That is far, far worse than a recession.

Gird your loins, folks. It’s going to get worse before it gets better.

0 Comments